free crypto tax calculator uk

Form 8949 Schedule D. Crypto Tax Calculator.

Crypto Tax 2021 A Complete Us Guide Coindesk

The free trial allows you to import data review transactions.

. 12570 Personal Income Tax Allowance. 10 to 37 in 2022 depending on your federal. Crypto tax breaks.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. This means you can get your books. We offer a free trial so you can try out our software and get comfortable with how it works.

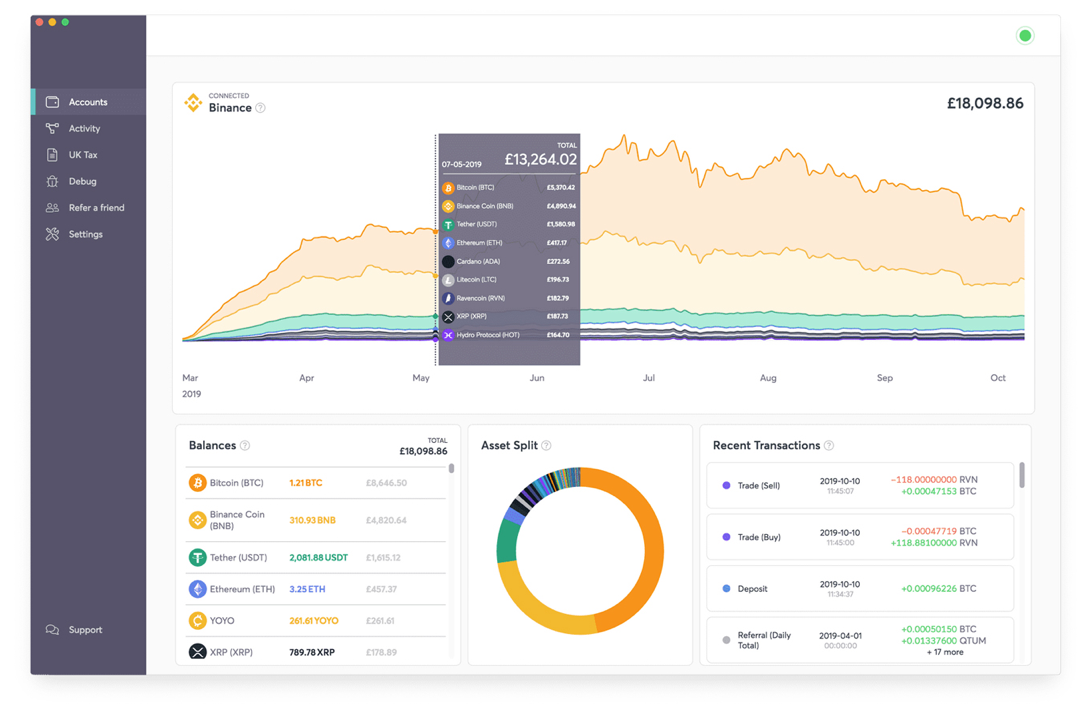

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. BittyTax is a collection of command-line tools to help you calculate your cryptoasset taxes in the UK.

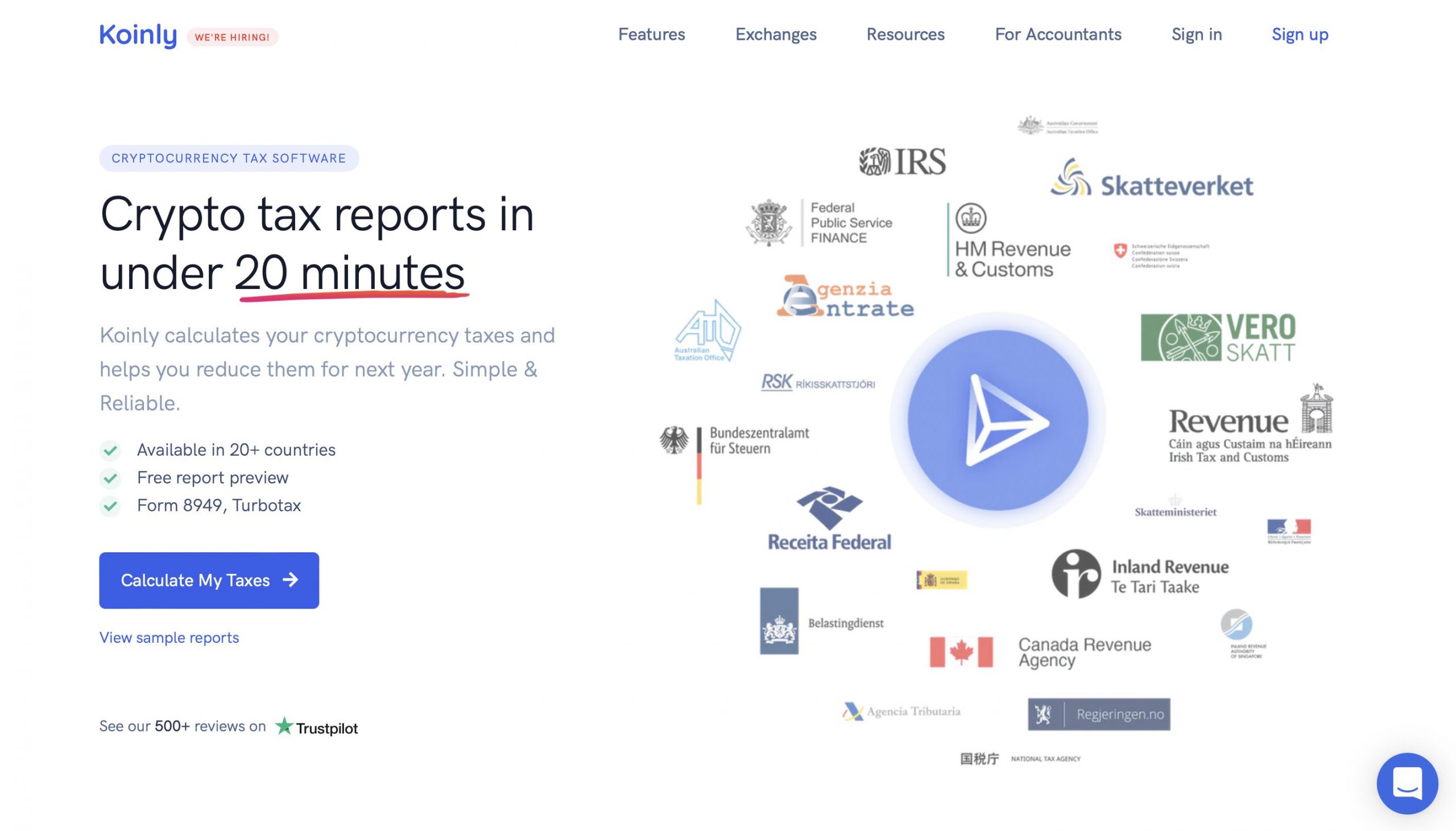

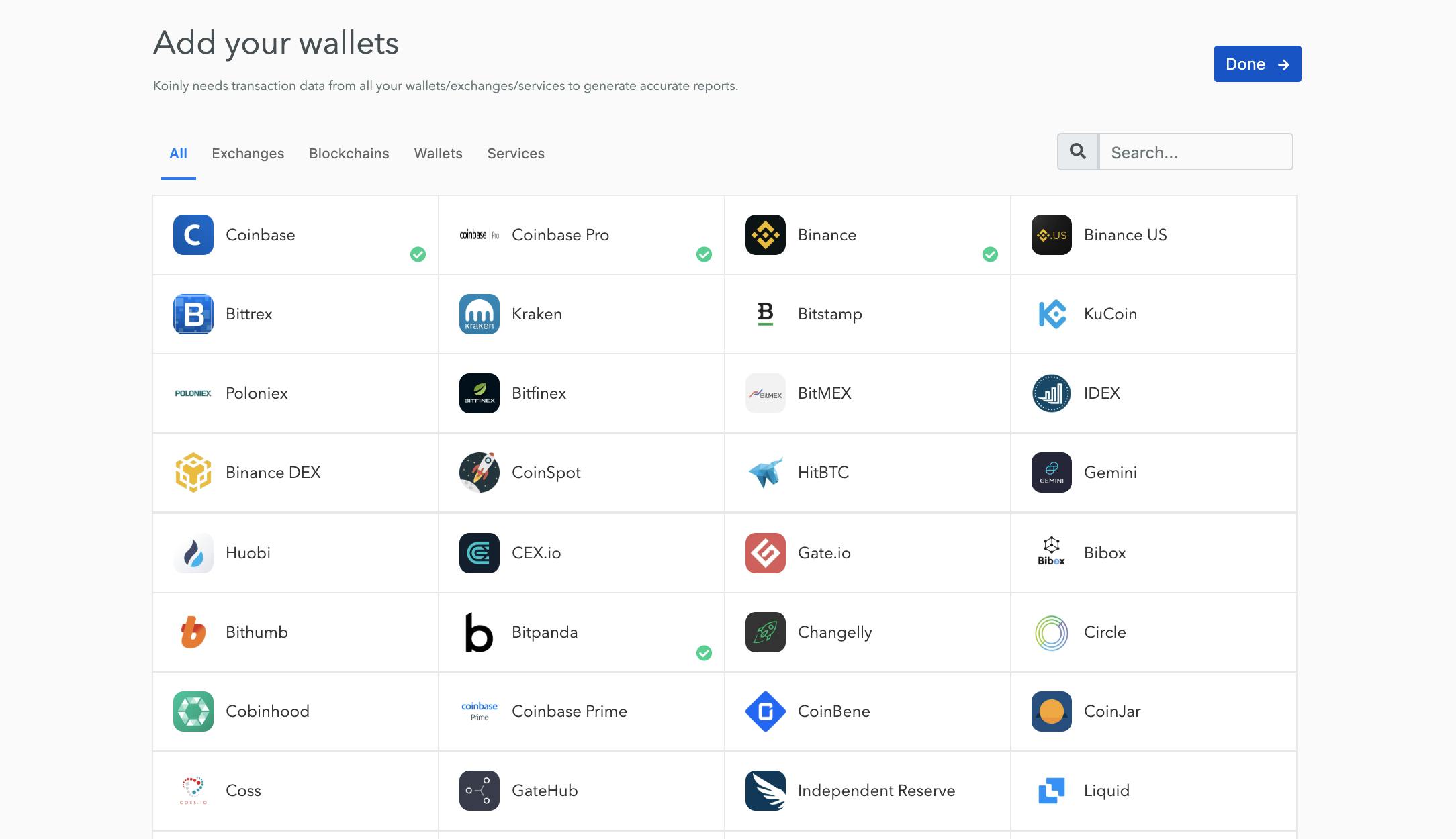

Koinly helps UK citizens calculate their crypto capital gains. What is covered in the free trial. February 12 2022 by haruinvest.

Koinly can generate the right crypto tax reports for you. UK crypto investors can pay less tax on crypto by making the most of tax breaks. Allowances for tax-free capital gains in the UK by year.

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. HMRC How to calculate capital gains UK. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

If youre looking to get started with a UK crypto tax calculator right away one of the following options is likely your best bet. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. If you are filing.

Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Whether you are filing yourself using a tax software like TurboTax or working with an accountant. Sold price This is the total value in AUD you disposed of the asset for eg.

Create your free account now. Straightforward UI which you get your crypto taxes done in seconds at no. It helps you calculate your capital gains using Share Pooling in accordance.

It takes less than a minute to sign up. How to calculate your UK crypto tax. As we have already mentioned you must calculate capital gains.

This tool is designed to be used by someone who is already familiar with. You simply import all your transaction history and export your report. Check out our free.

Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. 20 28 for residential property for your entire capital gain if your overall. Here are our Top Picks for Crypto Tax Calculators.

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

Best Crypto Tax Software Top Solutions For 2022

Koinly Free Crypto Tax Software

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Crypto Tax Reports Download Tax Forms Coinpanda

11 Best Crypto Tax Calculators To Check Out

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Koinly Free Crypto Tax Software

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Capital Gains And Tax Rates 2022

11 Best Crypto Tax Calculators To Check Out

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany

Best Bitcoin Tax Calculator In The Uk 2021

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto